Proteksyong Maaasahan, Presyong

Kayang-Kaya Mo.

Proteksyong Maaasahan, Presyong Kayang-Kaya Mo.

Protektado and Pamilya,

Kahit Busy Ka Pa!

Ang FlexiProtect + CARE ay magbibigay sa’yo ng proteksyon at kasiguraduhan sa kalusugan sa halagang ₱35 lang bawat araw.

Proteksyong abot-kaya pero malaking tulong sa oras ng pangangailangan

🔹 ₱3M coverage for as low as ₱35/day

🔹 Hindi na kailangan ng medical check up para maging tuloy-tuloy ang proteksyon mo

🔹 Pwedeng dagdagan ng hospital, critical illness, at accident benefits

*Sample FlexiProtect + Care premier for

30-year-old male, non-smoker,

with ₱1,000,000 sum insured and ₱2,000/day hospitalization allowance.

Protektado and Pamilya, Kahit Busy Ka Pa!

Ang FlexiProtect + CARE ay magbibigay sa’yo ng proteksyon at kasiguraduhan sa kalusugan sa halagang ₱35 lang bawat araw.”

Life and health plan na hindi makakasira ng budget pero malaking tulong sa oras ng pangangailangan.

🔹 ₱3M coverage for as low as ₱35/day

🔹 Hindi na kailangan ng medical check up para maging tuloy-tuloy ang proteksyon mo

🔹 Pwedeng dagdagan ng hospital, critical illness, at accident benefits

*Sample FlexiProtect + Care premier for

30-year-old male, non-smoker,

with ₱1,000,000 sum insured and ₱2,000/day hospitalization allowance.

Parang naranasan mo na rin ’to, ’di ba?

Umaasa lang sa HMO ng trabaho mo? Pero ‘pag na-hospital, kulang pa rin?

Pag umalis ka sa trabaho, goodbye na rin sa HMO

Nahilo ka na sa dami ng plans options?

May kausap kang ahente, pero parang bentahan lang, hindi personal?

Kung “oo” sagot mo sa kahit isa diyan .

Alam ko ang pakiramdam. Hindi ka nag-iisa.

I USED TO FEEL THE SAME

Gusto mong maging handa para sa pamilya mo, pero nakakalito kung paano magsisimula.

Ang dami kong tanong... pero walang klarong sagot.

Gusto mong maging handa, pero hindi mo alam kung saan magsisimula. Nakaka-stress.

Paano kung may emergency? Paano na ang pamilya ko?

UNTIL I FOUND THIS SOLUTION

Sa wakas, nakuha ko rin ang protection at peace of mind na matagal ko nang hinahanap, thanks to

AXA FlexiProtect!

Ito ang hanap kong simple pero solid na solusyon.

With FlexiProtect + Care, hindi mo kailangang pahirapan sarili mo.

It’s a 5-year term

life plan na may

₱3M panimulang coverage

starting at just ₱35 per day.

*Sample FlexiProtect + Care premier for 30-year-old male, non-smoker, with ₱1,000,000 sum insured and ₱2,000/day hospitalization allowance.

Introducing the "Cover Me" By Catherine of AXA

Wala kang pipirmahan na hindi mo naiintindihan.

Wala ring pilitan.

I explain ko sayo step by step

🔷 Libreng 1 on 1 na usapan

– para malaman ang tamang plan para sa’yo

🔷 Mga Planong akma sa pangangailangan mo

– based sa budget at goals mo

🔷Kasama mo pa rin ako, kahit nakakuha ka na ng plan.

– dahil gusto mong may makakaalalay, di ba?

Paano ito nag wo-work

Step 1:

Usap Tayo

Free consultation, kwentuhan lang about your goals and needs.

Step 2:

Tara Gabayan Kita

Tutulungan kita pumili ng plan na pasok sa budget mo at bagay sa goals mo.

Step #3:

Nasa'yo ang decision

Once you're ready, we'll go through the best option together. tutulungan kitang i process ang application.

Mga Kwento ng

Tiwala at Tagumpay

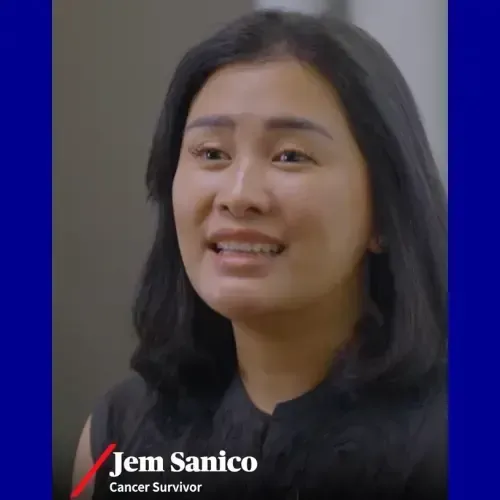

Jem Sanico

Cancer Survivor

At the age of 31, Jem's life turned upside down when she was diagnosed with cancer. With her resilience and the support of AXA Global Health Access, she was able to receive the best treatment during her darkest times. Today, our cancer warrior is now enjoying her second lease in life after remission.

Kitchie Lustestica

Cancer Survivor

Right after the joyous moment of giving birth to her son, Kitchie Lustestica had to face a life-changing cancer diagnosis.

her inspiring journey of strength, motherhood, and overcoming challenges with the help of a trusted partner.

Leidemor Bartolome

Car accident survivor

Leidemor Bartolome shares her journey of finding herself in the hospital after a car accident abroad, right in the middle of coping with the loss of her mother. Discover her inspiring tale of strength and how AXA Smart Traveller played a crucial role in helping her overcome the unexpected obstacle.

Alamin ang mga plano na nagbibigay proteksyon sa’yo at sa budget mo.

Tutulungan kitang hanapin ang Financial plan na swak sa’yo!

Savings & Investments

Health and Critical Illness

Travel Plan

Mas maaga kang mag-ipon, mas magaan ang future. Dito sa AXA, tinuturuan ka naming mag-invest nang maaga para masigurong may mapapala ka sa mga plano mo sa buhay.

Health emergencies come without warning. Make sure hindi ipon ang unang masasakripisyo

Travel smarter with

Smart Traveller!

Madali nang kumuha ng protection online. Here’s what’s included sa plan na ito!

Tutulungan kitang hanapin ang financial plan na swak sa’yo!

Savings & Investments

Mas maaga kang mag-ipon, mas magaan ang future. Dito sa AXA, tinuturuan ka naming mag-invest nang maaga para masigurong may mapapala ka sa mga plano mo sa buhay.

Health and Critical Illness

Health emergencies come without warning. Make sure hindi ipon ang unang masasakripisyo

Travel Plan

Travel smarter with

Smart Traveller!

Madali nang kumuha ng protection online. Here’s what’s included sa plan na ito!

ABOUT ME

Catherine Ruth Tagle

As a licensed financial coach and founder of Covered By Catherine of AXA, I am dedicated to helping individuals and families secure their financial futures. With years of experience and a client-centric approach, I ensure that each plan is tailored to your unique needs and circumstances.

I’ve helped many families and professionals finally understand the right financial plans without stress.

🌟 Gusto mo ng totoong tulong, hindi lang bentahan?

Ako na ‘yan 🌟

ABOUT ME

Catherine Ruth Tagle

As a licensed financial coach and founder of "Cover Me" By Catherine of AXA, I am dedicated to helping individuals and families secure their financial futures. With years of experience and a client-centric approach, I ensure that each plan is tailored to your unique needs and circumstances.

I’ve helped many families and professionals finally understand the right financial plan without stress.

🌟 Gusto mo ng gabay, totoong tulong, hindi lang bentahan? Ako na ’yan🌟

Frequently Asked Questions

Madalas Itanong

In most cases hindi na, May mga plan na hindi nangangailangan ng medical examination, usap tayo para macheck kung ano ang akma sa sitwasyon mo.

Oo! Pipili tayo ng coverage at riders base sa budget at pangangailangan mo.

🔁 Pwede mong i-renew o i-convert to a permanent whole life plan at good news hindi na kailangan ng medical exam para dito.

✨ Magpa book ng consultation, Usap tayo

Kung Ready ka nang siguraduhin ang future ng Pamilya Mo, tara!

'Wag mo nang hintayin ang emergency bago kumilos.

Start now. 💙 Get real protection for your family. Hassle-free and explained clearly.

POWERED BY FUNNEL OF BLESSINGS |COPYRIGHTS 2025 | TERMS & CONDITIONS

AXA Philippines, the AXA logo, and all related marketing materials are trademarks or registered trademarks of the AXA Group and are used here with proper acknowledgment. This website is owned and maintained by an authorized AXA Financial Advisor/Unit Manager for recruitment and educational purposes only. All rights to original content remain with AXA Philippines.

No copyright infringement is intended.

Some testimonials featured on this site are not proprietary and can be publicly viewed on the official AXA Philippines Facebook page. They are used here solely to inform and inspire, with full credit to AXA Philippines as the original source.

Get Your Free Coverage Quote in 60 Seconds

No pressure. No hidden fees. Just real options that fit your needs.

We respect your privacy.

Your information stays with us no spam, ever.